[ad_1]

Google manipulated advert auctions and inflated costs to increase revenue, harming advertisers, the Division of Justice argued final week within the U.S. vs. Google antitrust trial.

What follows is a abstract and a few slides from the DOJ’s closing deck, particular to go looking promoting, that again up the DOJ’s argument.

Google’s monopoly energy

This was outlined by the DOJ as “the facility to regulate costs or exclude competitors.” Additionally, monopolists don’t have to contemplate rivals’ advert costs, which testimony and inside paperwork confirmed Google doesn’t.

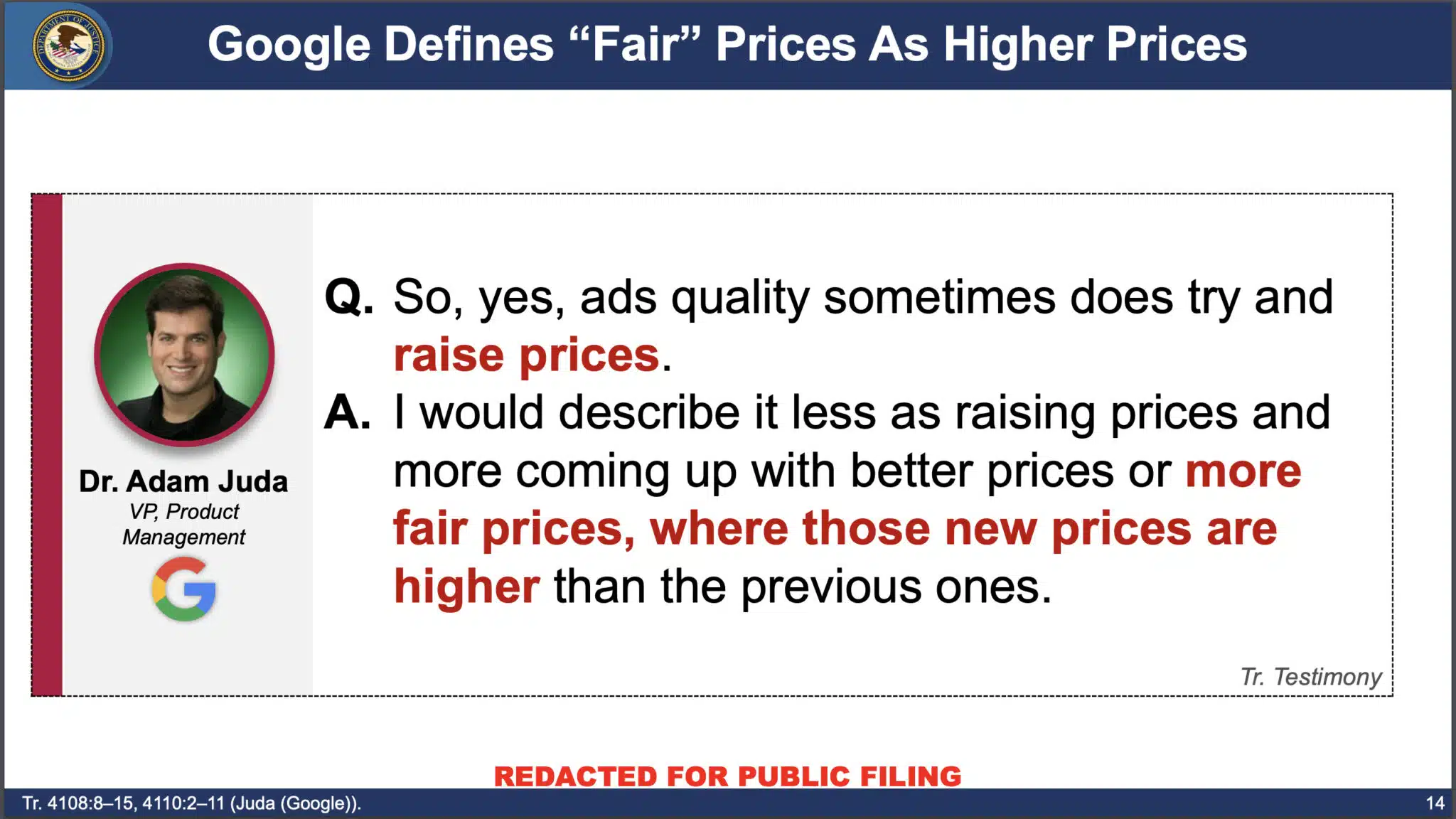

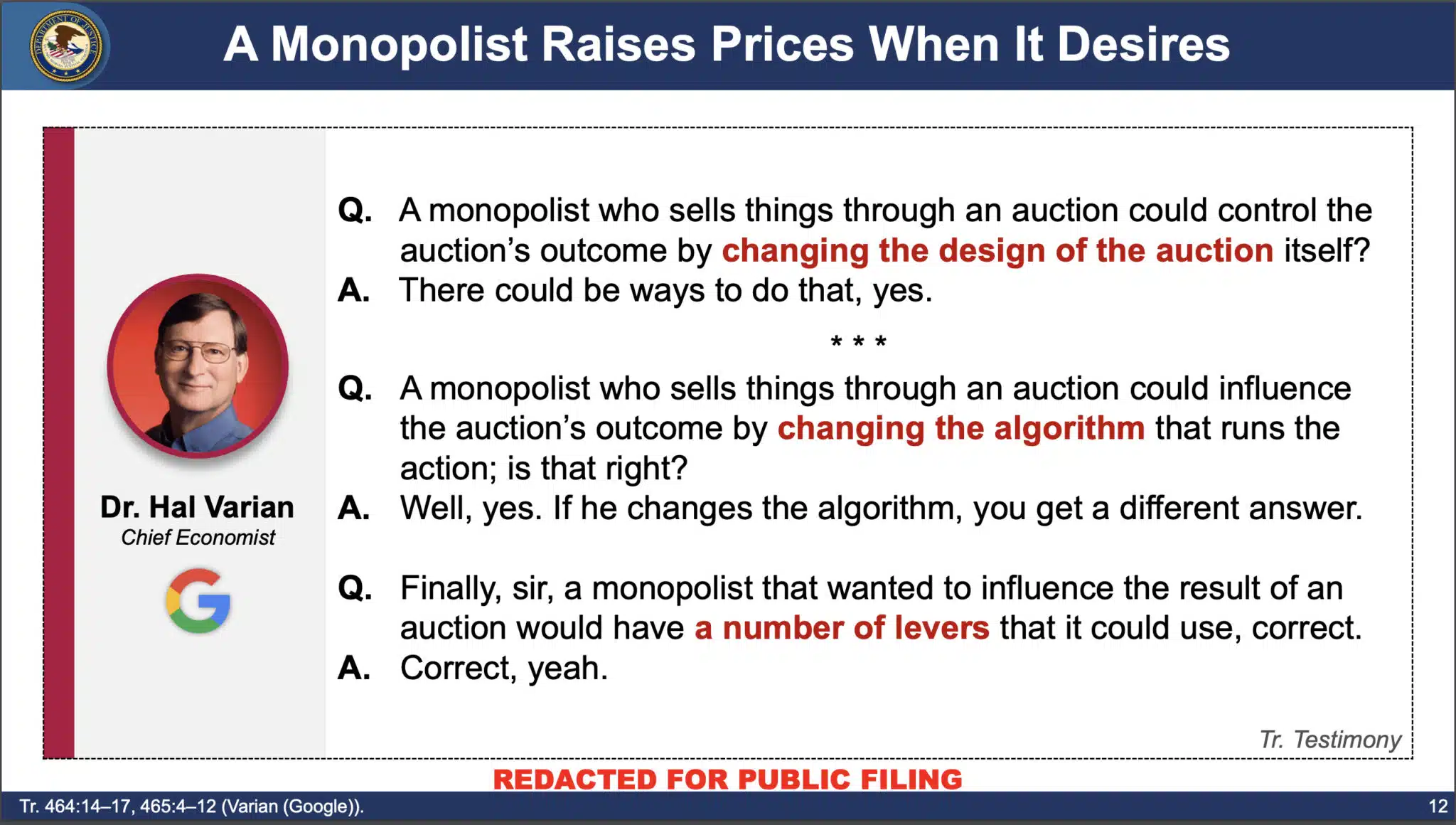

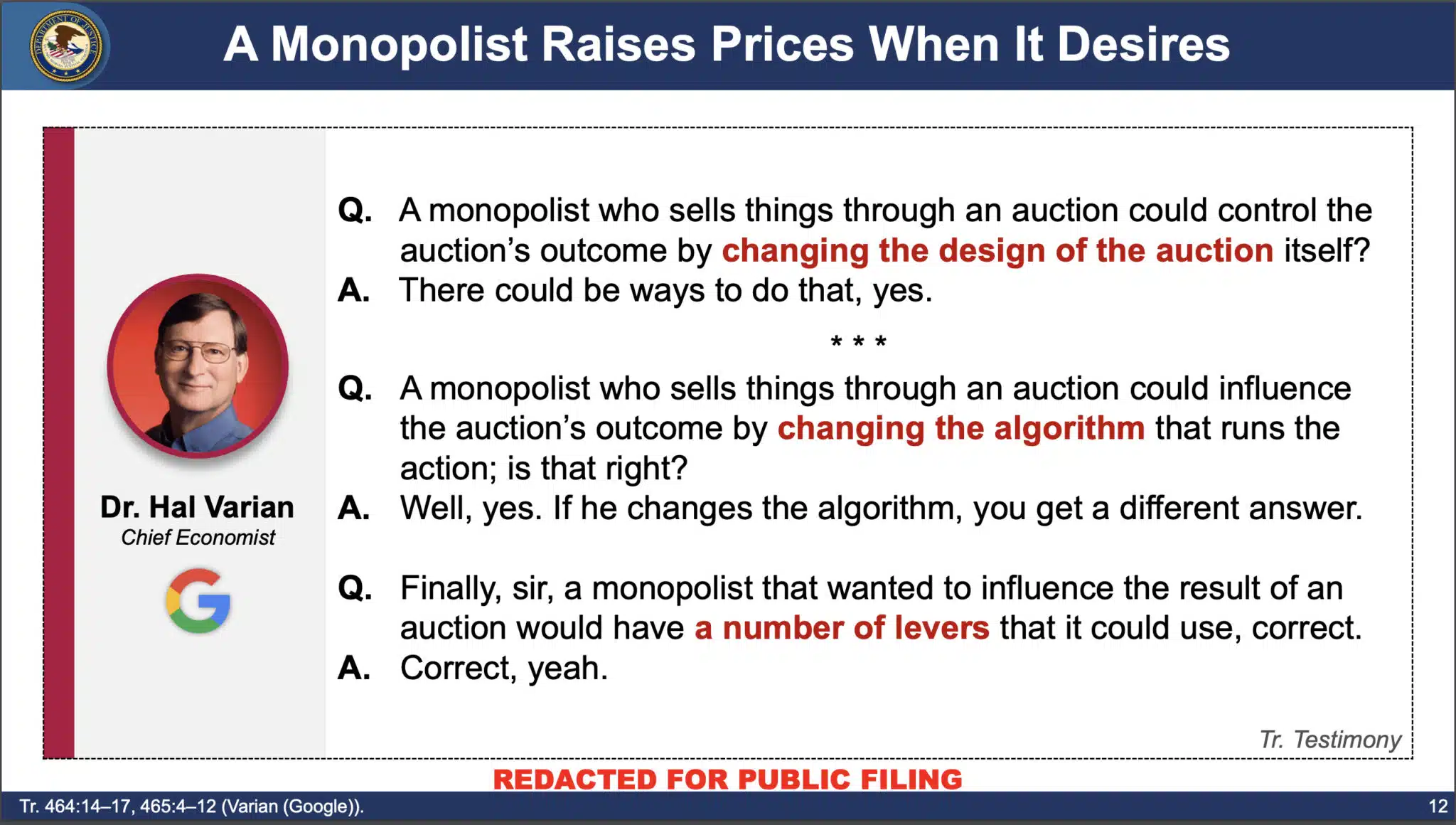

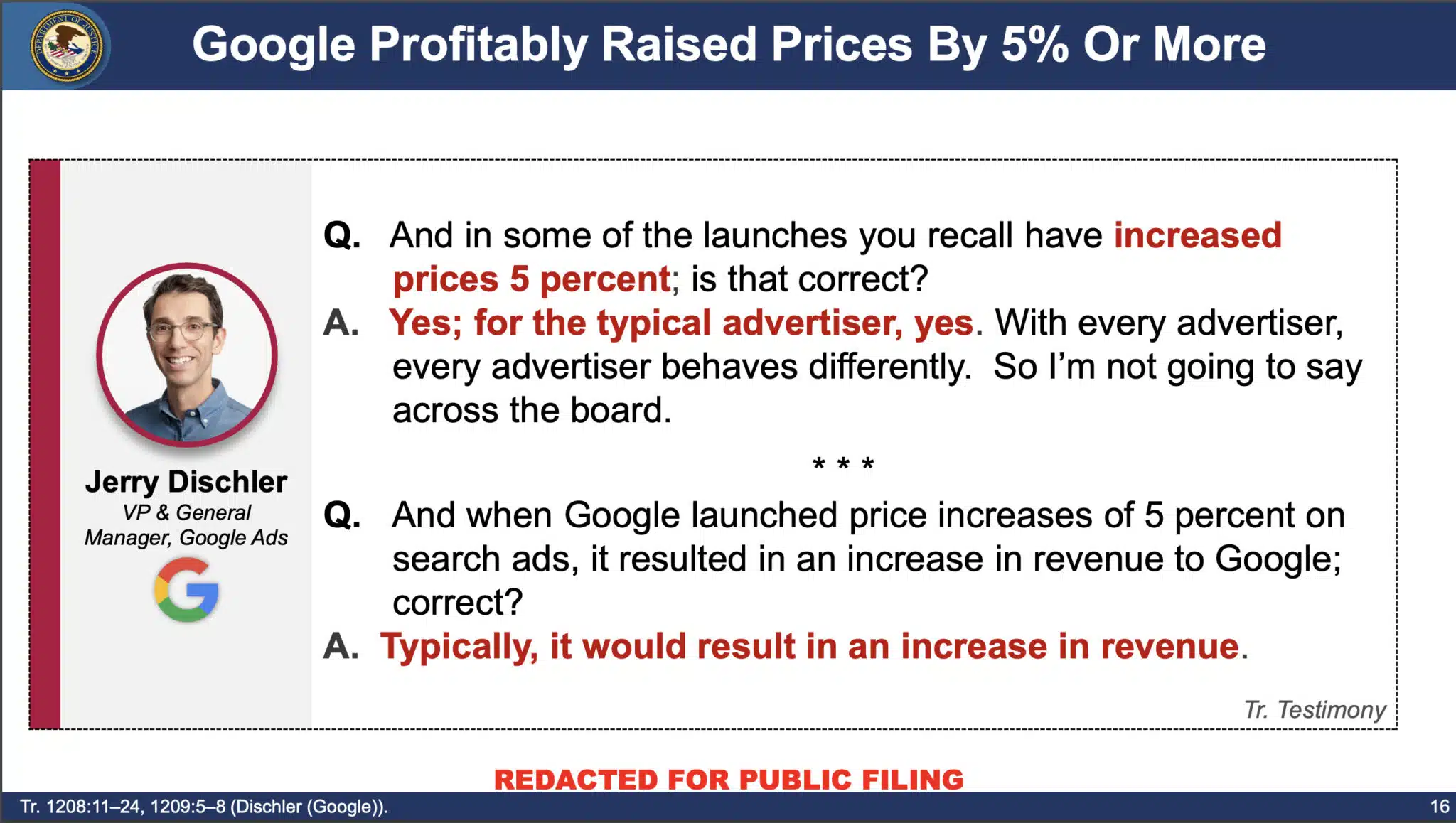

To make the case, the DOJ confirmed quotes from numerous Googlers discussing elevating advert costs to extend the corporate’s income.

- Dr. Adam Juda mentioned Google tried to provide you with “higher costs or extra honest costs, the place these new costs are greater than the earlier ones.”

- Dr. Hal Varian indicated that Google had many levers it may use to vary the advert public sale design to realize its desired final result.

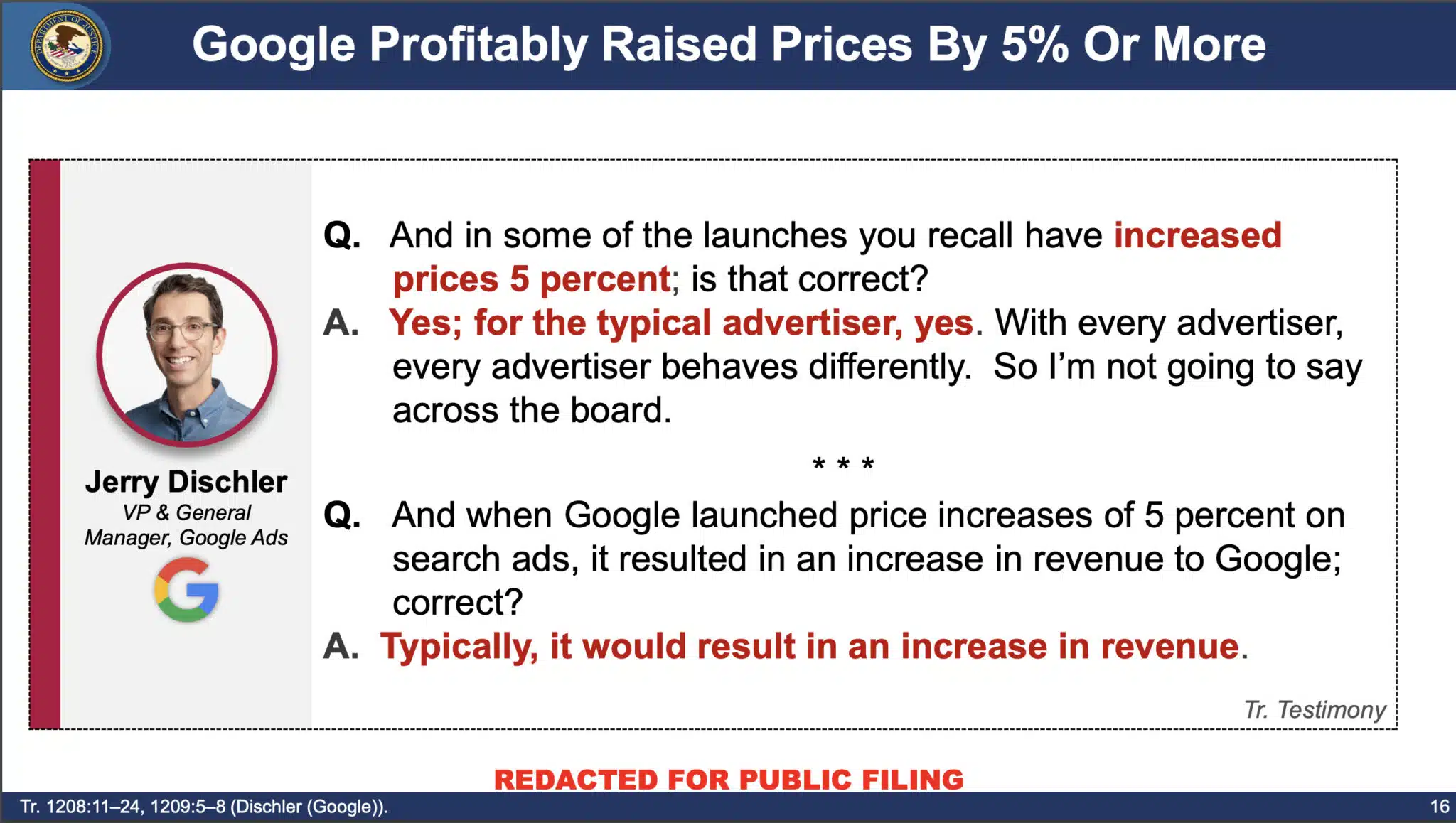

- Juda and Jerry Dischler confirmed this. Dischler was quoted discussing the impression of accelerating costs from 5% to fifteen% in these two slides:

Different slides from the deck the DOJ used to make its case:

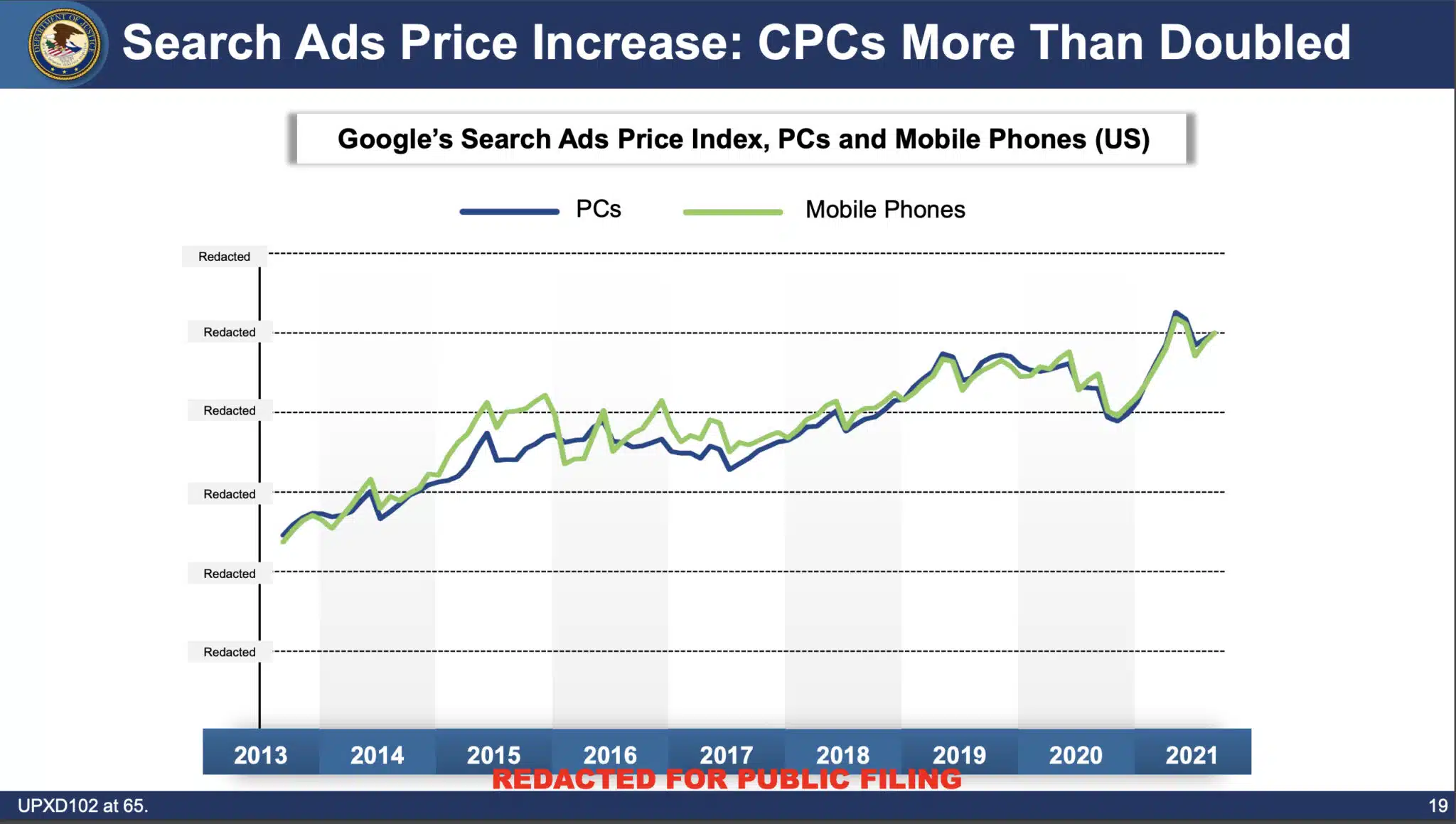

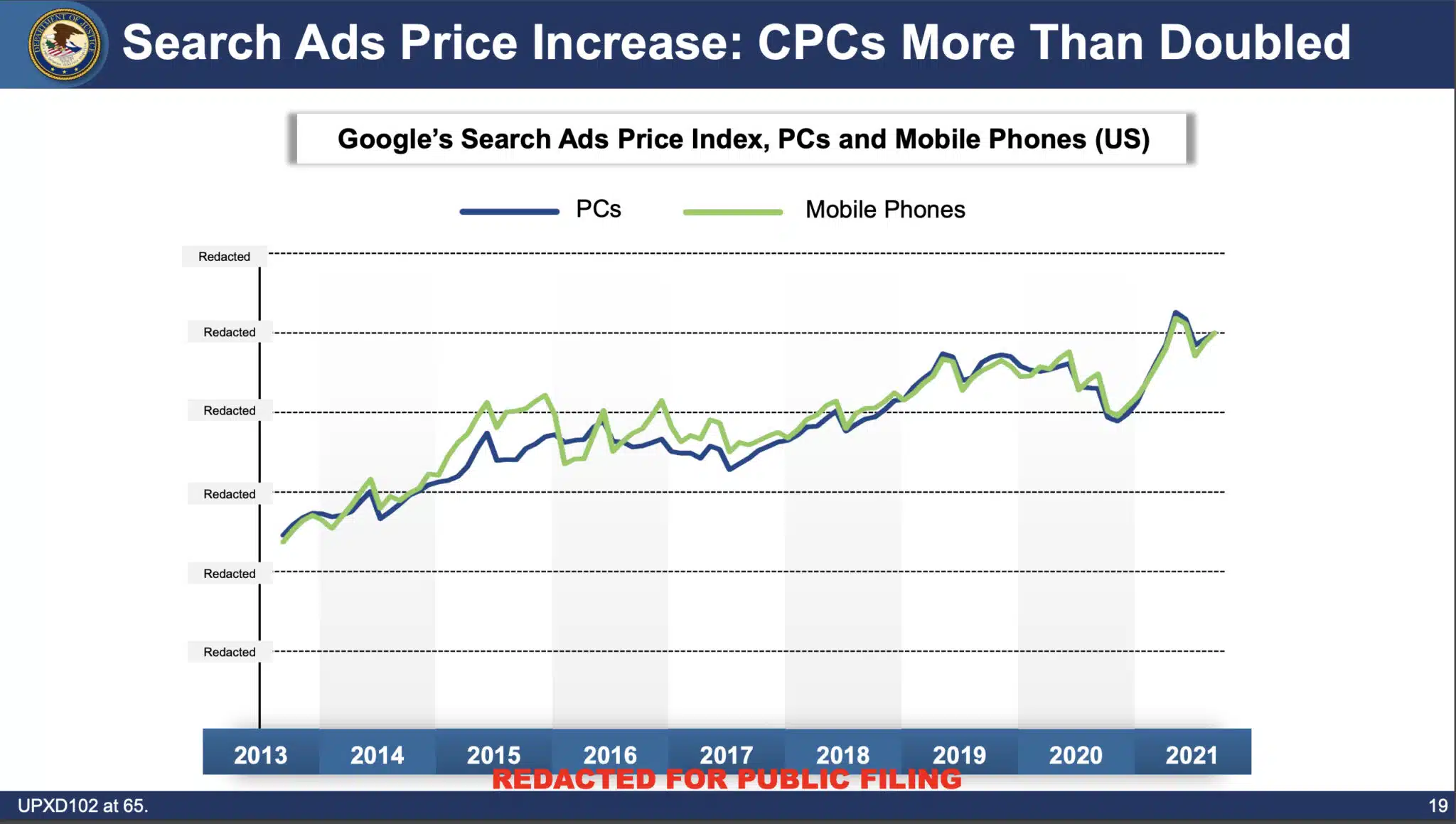

- Google Search advert CPCs greater than doubled between 2013 and 2020.

Advertiser hurt

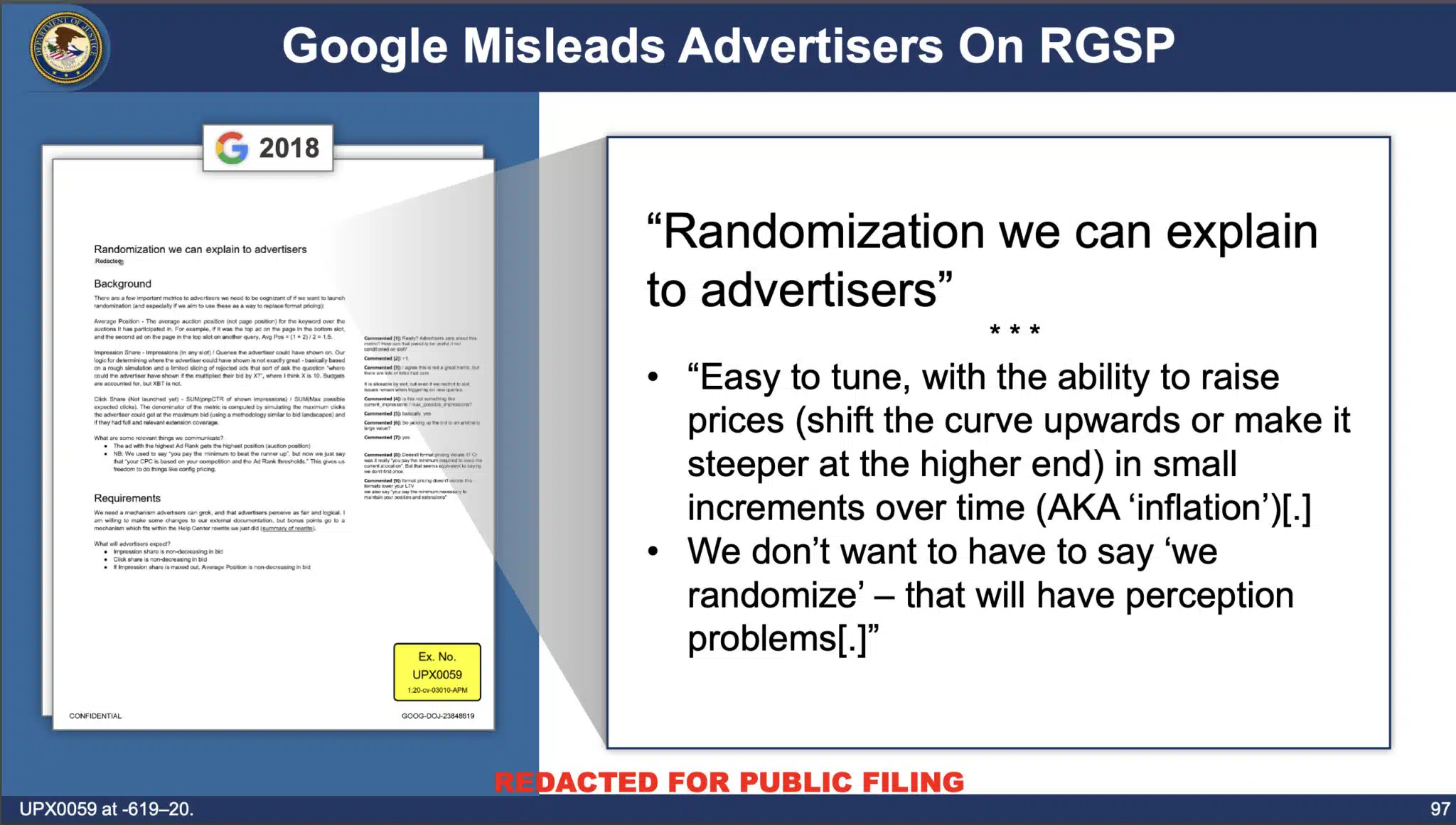

Google has the facility to boost costs when it needs to take action, based on the DOJ. Google known as this “tuning” in inside paperwork. The DOJ known as it “manipulating.”

Format pricing, squashing and RGSP are three issues harming advertisers, based on the DOJ:

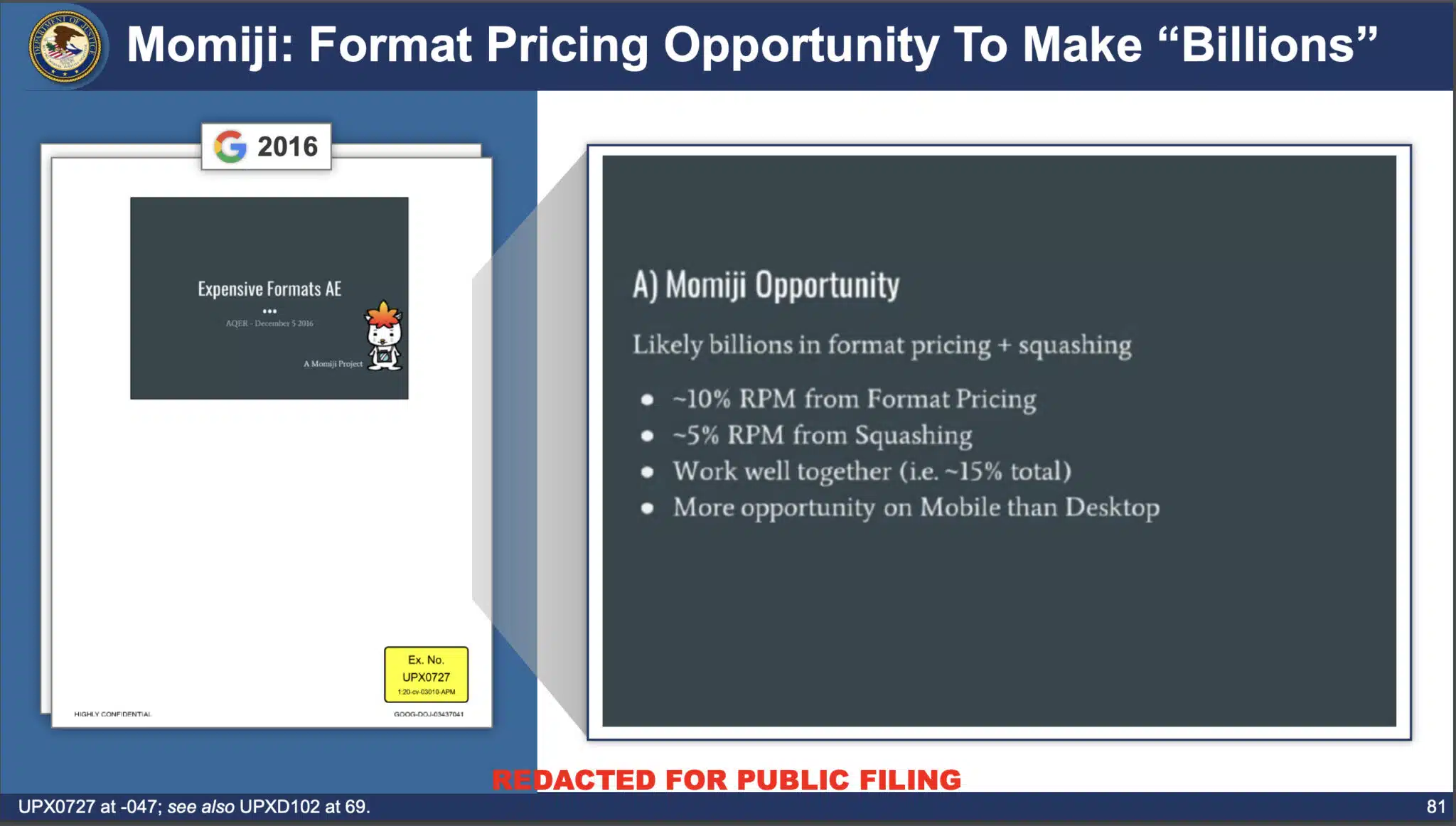

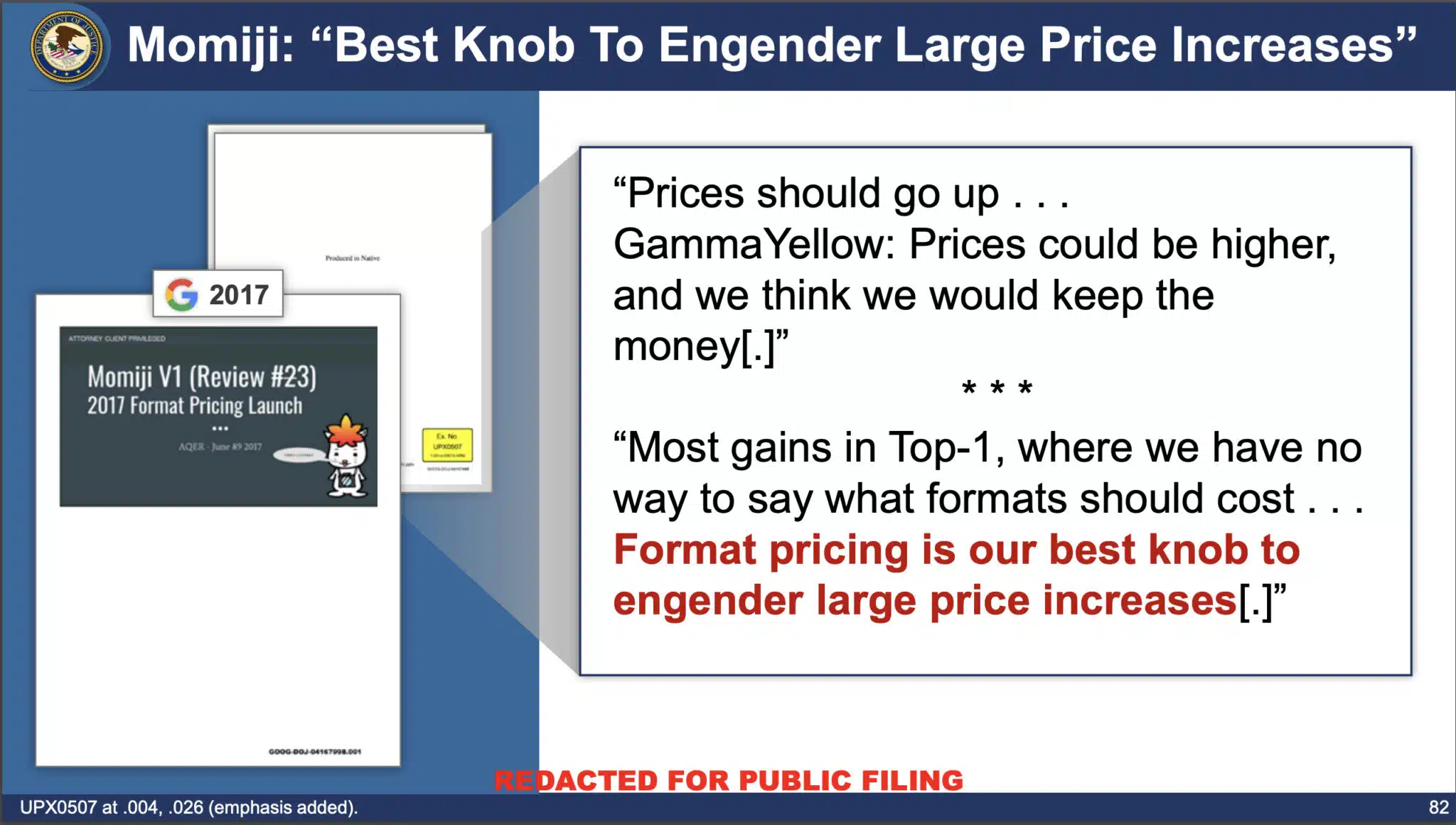

Format pricing

- “Advertisers by no means pay greater than their most bid,” based on Google.

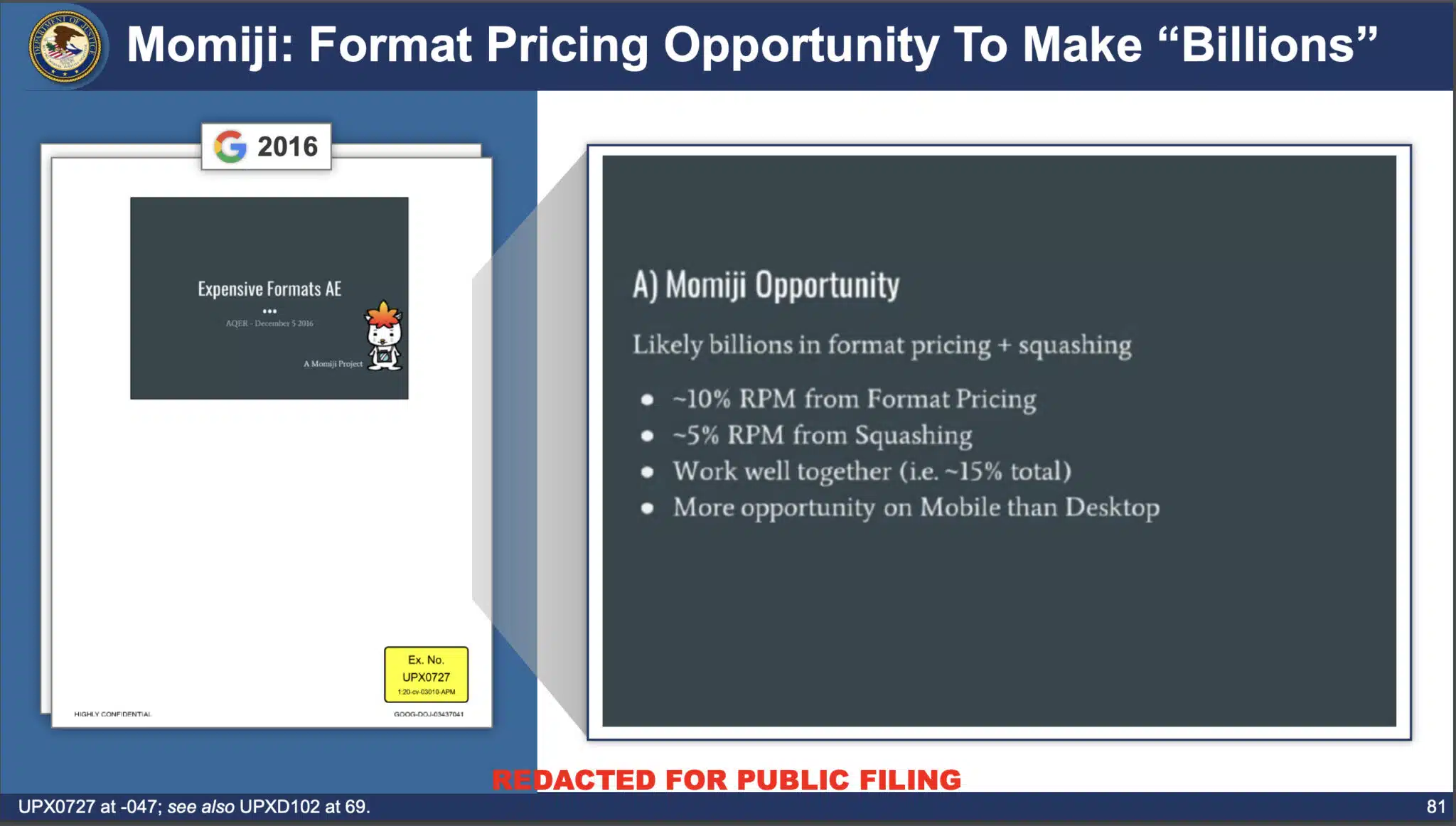

- Sure, however: What Google failed to say is “Venture Momiji,” which very quietly launched in 2017.

- What’s Momiji: It artificially inflated the bid made by the runner-up.

- The end result: A 15% enhance for the “profitable” advertiser. Extra advert income for Google.

- Related slides: From the DOJ’s deck:

Squashing

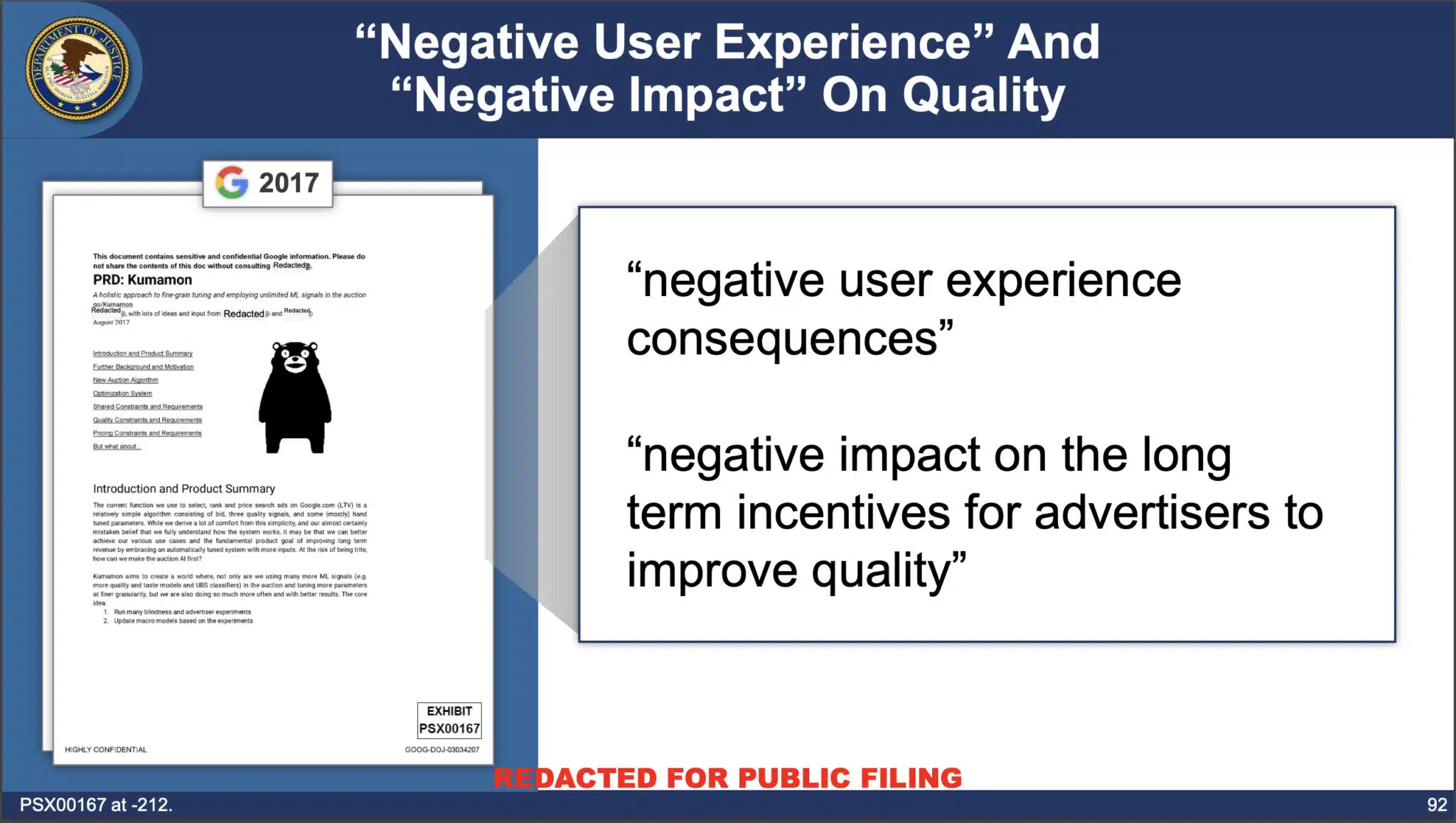

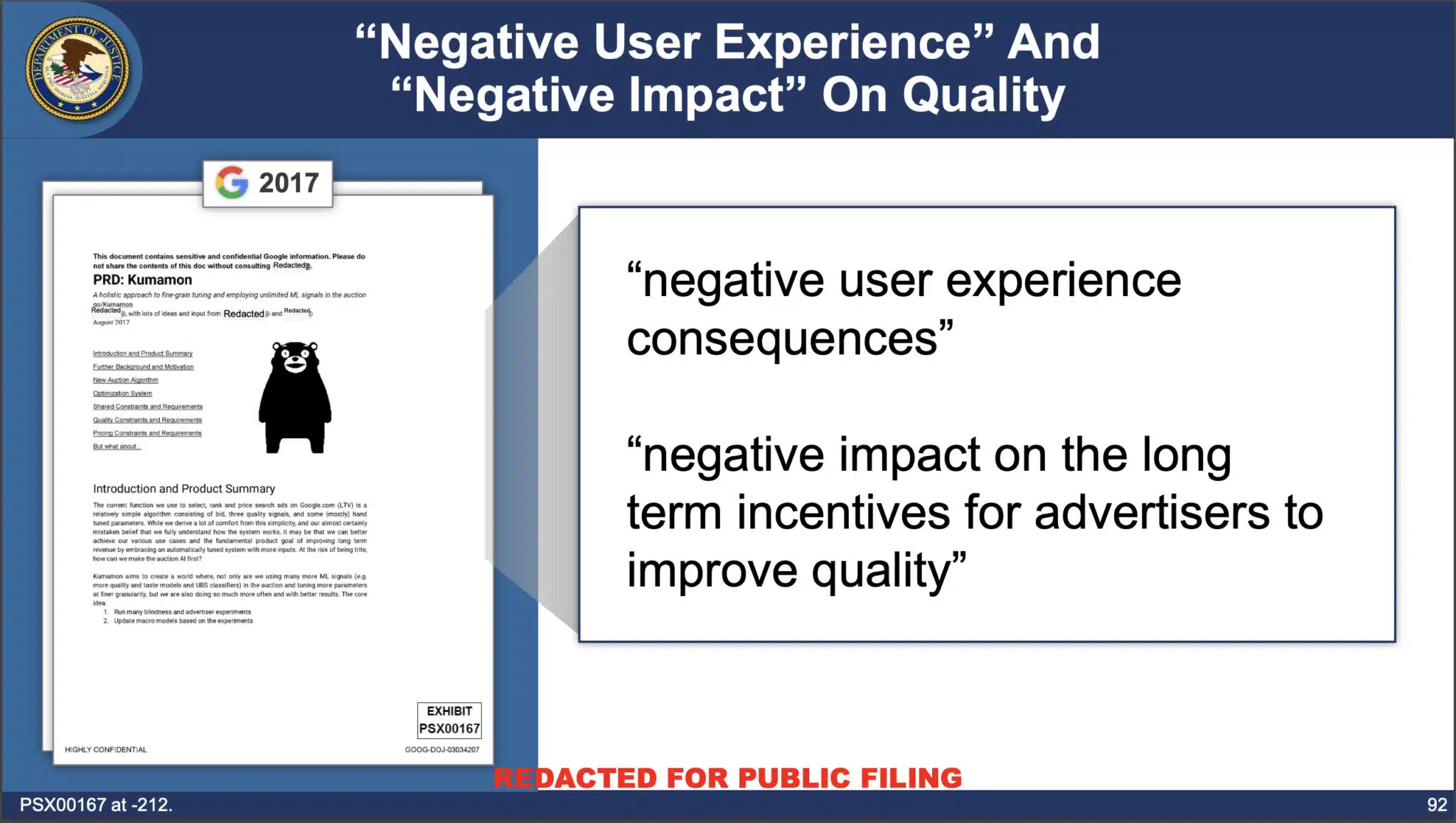

- The way it labored: Google elevated an advertiser’s lifetime worth primarily based on how far their predicted click-through fee (pCTR) was from the best pCTR. Based on a 2017 doc introducing a brand new product known as “Kumamon,” Google had been doing this utilizing “a easy algorithm consisting of bid, three high quality indicators, and a few (principally) hand tuned parameters.” (A screenshot of this doc appeared to point Kumamon would add extra machine studying indicators within the public sale.)

- In different phrases: Google raised “the worth in opposition to the best bidder.”

- Google’s aim: To create a “extra broad value enhance.”

- The end result: The Google advert public sale winner paid greater than it ought to have if squashing wasn’t a part of the advert public sale.

- And: The DOJ indicated this all led to a “adverse consumer expertise” as Google ranked advertisements “sub-optimally in trade for extra income.”

- Related slides: From the DOJ’s deck:

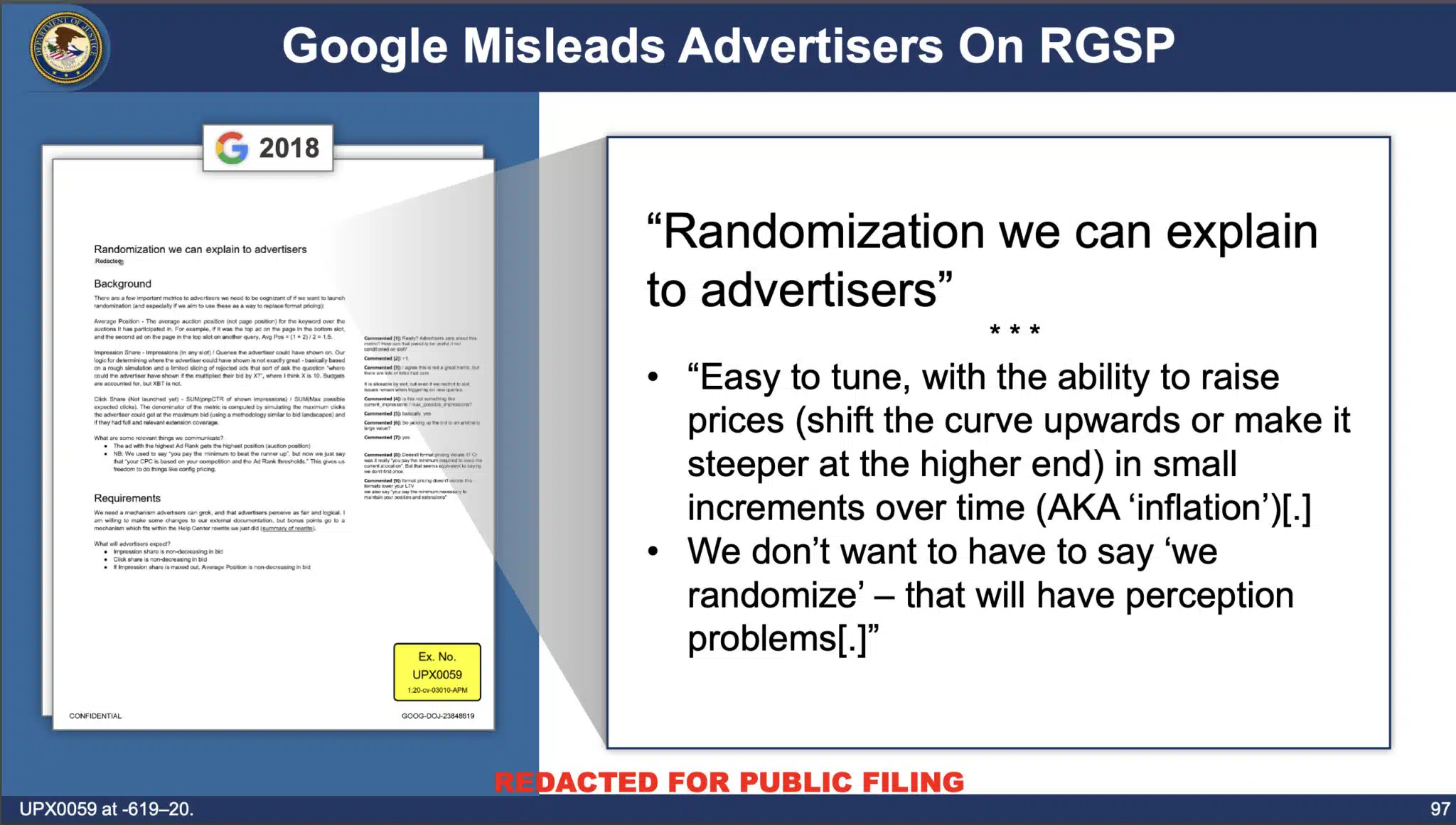

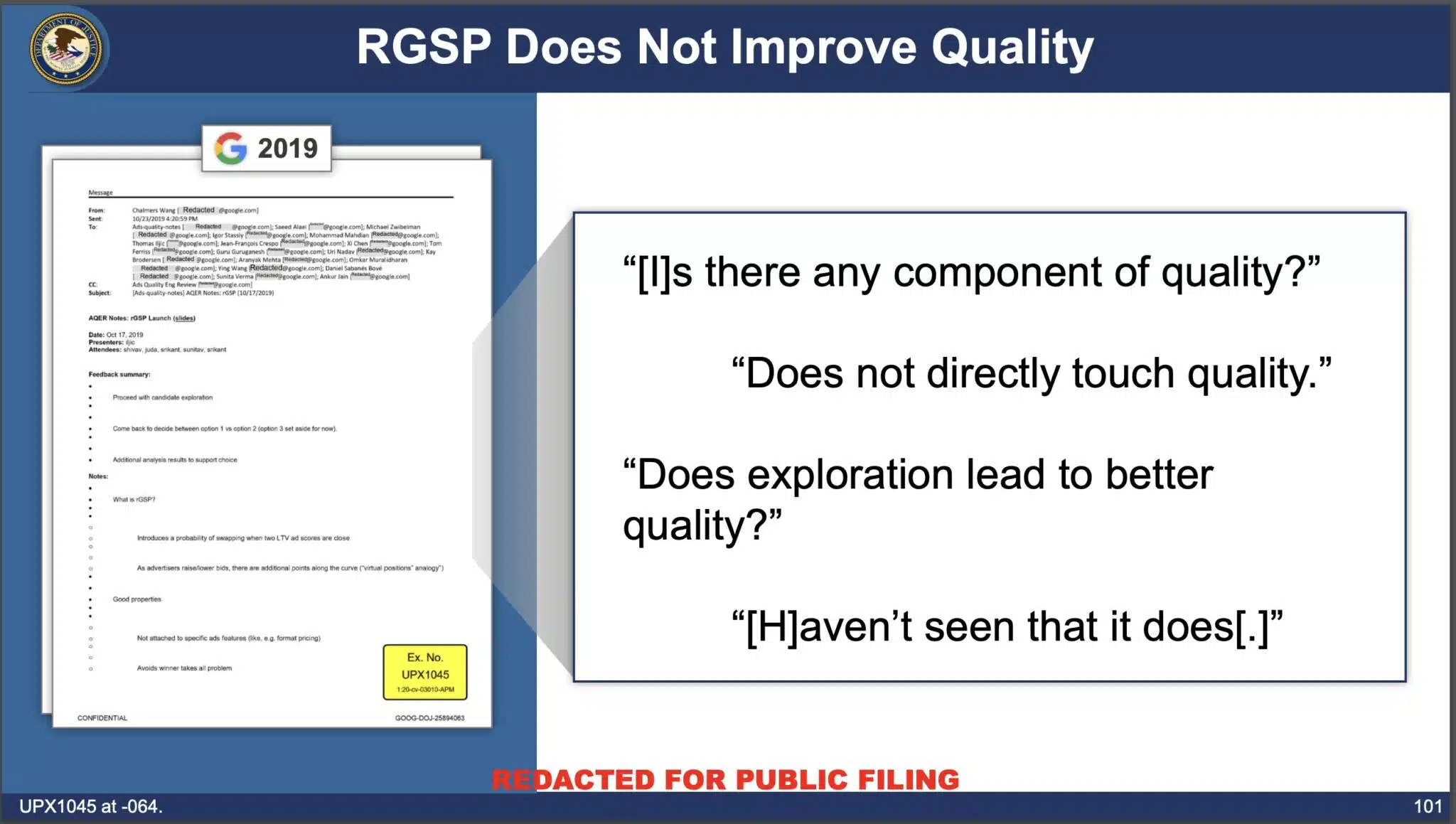

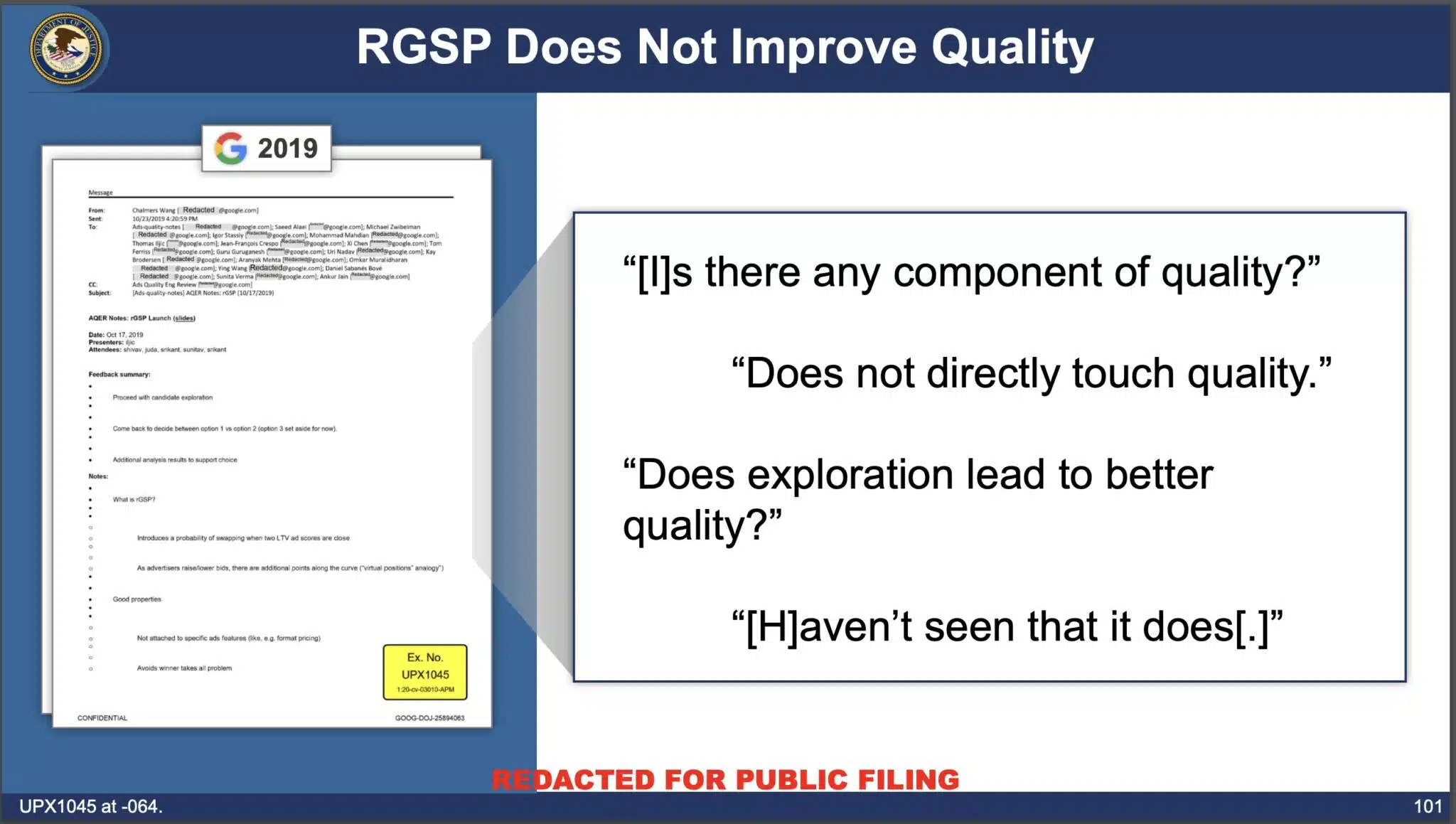

RGSP

- What’s it: The Randomized Generalized Second-Worth was launched in 2019. (Dig deeper. What is RGSP? Google’s Randomized Generalized Second-Price ad auctions explained)

- The way it labored: Google referred to it as the power to “increase costs (shift the curve upwards or make it steeper on the greater finish) in small increments over time (AKA ‘inflation’). It didn’t result in higher high quality, based on 2019 Google emails.

- How Google talked about it: “A greater pricing knob than format pricing.”

- The end result: It incentivized advertisers to bid greater. Google elevated income by 10%.

- Related slides: From the DOJ’s deck:

Search Question Studies

The shortage of question visibility additionally harms advertisers, based on the DOJ. Google makes it practically inconceivable for search entrepreneurs to “establish poor-matching queries” utilizing adverse key phrases.

The DOJ’s presentation. You possibly can view all 143 slides from the DOJ: Closing Deck: Search Advertising: U.S. and Plaintiff States v. Google LLC (PDF)

New on Search Engine Land

[ad_2]

Source link